Thinking about a breast lift but worried about the cost? Figuring out insurance coverage can feel like a maze, but it doesn’t have to be. This guide will walk you through everything you need to know about whether your insurance will cover a breast lift. We’ll break down what makes a difference in getting approval, how to talk to your insurance company, and what to do after your surgery. Whether you’re unsure if a breast lift is medically necessary for you or just want to understand your options better, we’ve got you covered. Let’s get started on understanding the financial aspects of this transformative procedure!

Understanding Breast Lift Coverage

So, you’re considering a breast lift, also known as mastopexy, but the cost is a major concern. A natural question pops up: Will my insurance company help cover it? Let’s dive into the details. The simple answer is often “no,” unless there’s a clear medical reason. But, let’s explore that “unless” part, because there’s more to the story, including specific conditions and criteria that might qualify you for coverage.

Cosmetic vs. Medically Necessary: Understanding Coverage Criteria

The key difference hinges on whether your insurance company classifies your breast lift as purely cosmetic or medically necessary. A purely cosmetic procedure, aimed solely at improving appearance, is usually not covered. Insurance companies generally view these as elective enhancements. However, if your sagging breasts cause genuine health problems, the situation changes significantly. We’re talking about conditions that genuinely impact your health and well-being, not just how you feel about your looks.

Consider these scenarios that may prompt insurance companies to consider coverage:

- Chronic Back Pain: Excessive breast weight can cause persistent back, neck, or shoulder pain that doesn’t respond to conservative treatments like physical therapy or pain medication.

- Skin Infections: Recurring skin infections or rashes (intertrigo) under the breasts, often due to the skin folds rubbing together and creating a moist environment.

- Posture Problems: Severe sagging can cause you to hunch over, leading to posture issues and related discomfort.

- Nerve Issues: Heavy breasts can sometimes cause tingling or numbness in your arms and hands.

- Breast Asymmetry: Significant asymmetry, especially after breast cancer surgery (lumpectomy or mastectomy), can lead to functional problems and may warrant a lift to achieve symmetry.

These are the types of issues that might convince your insurance provider to cover the procedure.

But what qualifies as “significant” enough to justify medical necessity? That’s where things get a little subjective. Your surgeon plays a crucial role here. They’ll need to create a strong medical narrative demonstrating a direct connection between your breast condition and your health problems. They need to clearly explain how your breasts are negatively affecting your daily life. It’s not simply about how your breasts look; it’s about the impact on your overall health and functional ability.

Building a Strong Case for Insurance Coverage: A Step-by-Step Guide

Getting your insurance company on board is like building a compelling case. Here’s your step-by-step guide to improve your chances:

- Find the Right Surgeon: Seek out a board-certified plastic surgeon who has extensive experience navigating the insurance process for breast lifts. They understand the necessary documentation, the language insurance companies use, and the specific criteria insurers look for. They’ll be your key ally throughout this process. Ask about their success rate in getting insurance coverage for medically necessary breast lifts. Inquire if they have a dedicated staff member who handles insurance pre-authorizations and appeals.

- Comprehensive Medical Records – Your Evidence: Gather all your relevant medical information. This includes doctor’s notes, imaging results (like mammograms, if applicable), and records of previous treatments you’ve had, such as physical therapy for back pain, dermatology visits for skin infections, or chiropractic care for posture problems. Your surgeon will guide you on what to collect and how to organize it effectively. The more detailed and comprehensive your documentation, the stronger your case. Include dates, specific treatments, and the effectiveness (or lack thereof) of those treatments.

- Understand Your Policy Inside and Out: Before you even schedule a consultation, thoroughly review your insurance policy. Pay close attention to sections covering breast surgery, reconstructive surgery, and specifically, any exclusions for mastopexy. Note any pre-authorization requirements, specific limitations, or exclusions. Understanding your policy terms is crucial. Look for language related to “medically necessary” procedures and the criteria used to determine medical necessity.

-

The Pre-Authorization Process – Getting the Green Light: Your surgeon’s office will submit a formal pre-authorization request to your insurance provider. This request details the proposed procedure, explains its medical necessity based on your documented health issues, and outlines the expected costs. The request will include:

- A detailed letter of medical necessity from your surgeon, explaining your condition, symptoms, and how a breast lift will alleviate them.

- Supporting medical records, including physician notes, imaging reports, and treatment history.

- Photographic documentation of your breast condition.

- A CPT code for the procedure (Current Procedural Terminology – used for billing).

- A diagnosis code (ICD-10 code) that reflects the medical necessity of the procedure.

Be prepared—insurance companies may deny the initial request. If this happens, don’t give up! Most insurers have an appeals process, and your surgeon’s office can help you navigate this complex aspect of the process.

5. Meticulous Documentation – Keep Track of Everything: Keep copies of all correspondence with your insurance company. This documentation includes the initial pre-authorization request, any denials, and any appeals or supporting medical documents you submit. Note the dates of all calls and the names of the representatives you speak with. This meticulously organized trail of paperwork is your proof should you need to escalate the issue. It’s your safety net.

Financial Planning: Beyond the Surgery Itself

Even if you get some insurance coverage, be prepared for out-of-pocket expenses. This may include deductibles, co-pays, and co-insurance (the percentage of the cost you’re responsible for after your deductible is met). Don’t forget the costs of anesthesia and facility fees, which may or may not be fully covered. The total cost could easily exceed your initial expectations.

Explore various financing options such as:

- CareCredit: A credit card specifically for healthcare expenses.

- Medical loans: Personal loans from banks or credit unions earmarked for medical procedures.

- Payment plans: Some surgeons offer in-house payment plans.

- Health Savings Account (HSA) or Flexible Spending Account (FSA): If you have one, you may be able to use it to cover some of the costs.

Budgeting and planning ahead are key to managing this expense effectively. Get a detailed cost estimate from your surgeon’s office, including all potential fees.

Surgical Techniques and Cost Considerations

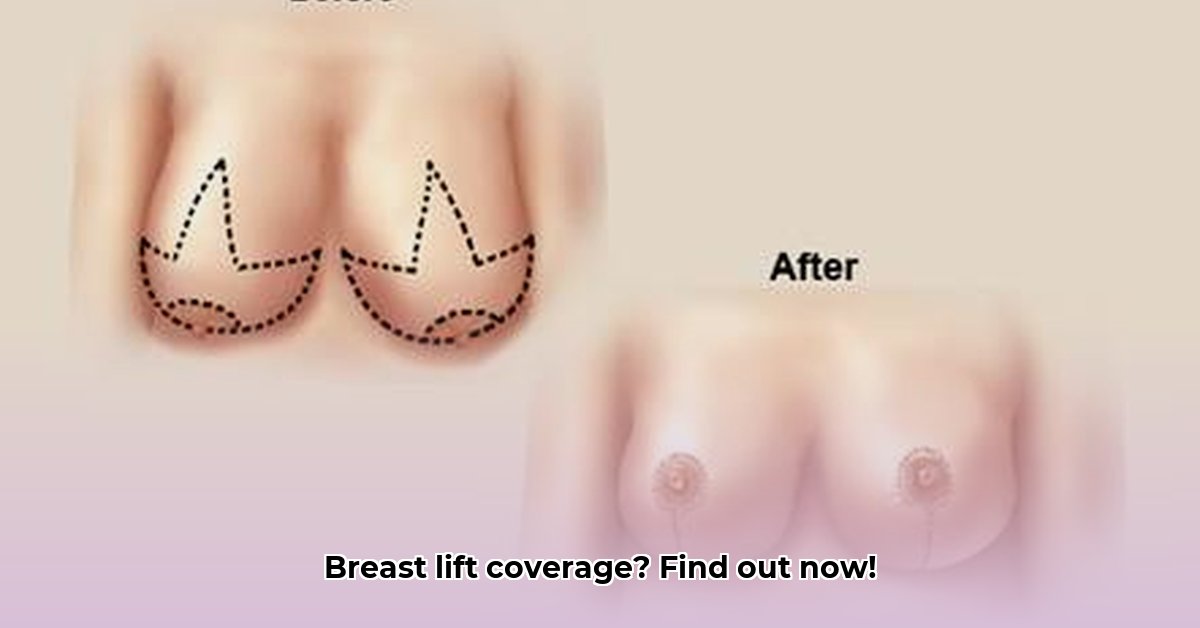

There are several different surgical methods for breast lifts, including:

- Anchor (or Wise Pattern) Lift: Involves incisions around the areola, vertically down to the breast crease, and along the breast crease. This is typically used for significant sagging.

- Lollipop Lift (Vertical Incision Lift): Involves incisions around the areola and vertically down to the breast crease. Used for moderate sagging.

- Donut Lift (Periareolar Lift): Involves an incision only around the areola. Suitable for minimal sagging.

- Crescent Lift: A crescent-shaped incision above the areola. Often combined with breast augmentation.

Each technique differs in cost, recovery time, and the final aesthetic result. The “scarless” lift may involve liposuction to reduce breast volume in order to lift the position of the breast. These are essential factors to consider with your surgeon. Weighing the cost of different options against your desired outcome is a crucial part of planning. More extensive procedures typically cost more.

The Power of Documentation: Make it Crystal Clear

Your insurance claim’s success depends on the strength of the medical narrative demonstrating the direct link between your breast condition and your health problems. Detailed medical records are paramount. Your surgeon should ideally provide high-quality photographic documentation alongside written reports; pictures can speak louder than words, particularly to an insurance reviewer. Following your insurer’s specific guidelines is essential for a smooth process. Ensure photos are taken in a clinical setting with proper lighting and positioning, as specified by your insurance company.

Does insurance cover a breast lift? The answer isn’t a simple yes or no. It depends largely on the presence of a verifiable medical need and your ability to convincingly demonstrate that need in line with the insurance company’s standards. The process may seem complex, but preparing a strong case, armed with thorough documentation and a proactive approach, significantly increases your chances of securing at least partial coverage. Remember, navigating this process takes time and effort, but understanding the steps empowers you to make informed decisions.

How to Successfully Appeal a Denied Breast Lift Insurance Claim

Key Takeaways:

- Insurance coverage for breast lifts often depends on proving “medical necessity,” not just cosmetic reasons.

- Thorough documentation is crucial for approval, including physician letters, photos, and your complete medical history.

- Understanding your insurance policy and pre-authorization requirements is vital.

- Appealing a denied claim requires careful preparation and a clear understanding of the process.

- Knowing your rights under laws like the Women’s Health and Cancer Rights Act (WHCRA) can

- Stainless Food Storage Keeps Your Kitchen Organized And Meals Fresh - February 28, 2026

- Stainless Steel Food Storage for Healthier, Eco-Friendly Meal Prep - February 27, 2026

- Stainless Food Containers Offer Durable Storage for Everyday Meals - February 26, 2026